Bonds can be a valuable asset in the defensive part of portfolios as they are a great tool to get a little bit of extra income without taking on a whole heap of additional risk – provided you pick the right bonds of course!

Trying to explain every aspect of bond investing in a single sitting would likely be a little overwhelming, not to mention time consuming, so I am going to break down bond investing into three parts – beginner, intermediate and advanced.

The beginner guide will give you the basics of what a bond is, the key features of bonds, how they can form part of an investment portfolio and how to get exposure to bonds. So let’s get cracking!

What is a bond?

A bond is essentially a loan so when you buy a bond you are basically acting as a lender of money or, more accurately put, a debtholder. The issuer of the bond, which is normally the government or a company, is the borrower – they create the bond.

Like most lender/borrower relationships there are two key aspects – the interest that borrower gives to the lender for the pleasure of having their money and the loan repayment date.

In the bond market the interest paid to the lender (in this case the investor) is known as a coupon payment and it is normally paid semi-annually. The size of the coupon payment is always tied to the bond’s initial issuance value (the par value) and is quoted as a percentage of the par. This is known as the coupon rate. Put mathematically, the coupon rate is the annual coupon payments divided by the par value of the bond.

Coupon rate = annual coupon / bond par value

Generally, the coupon rate is going to be higher or lower depending on who you are lending money to. For example, if you buy an Australian government bond you can expect a lower coupon rate than if you bought a corporate bond such as a bank bond. This is because the chances of the Australian government defaulting on the bond are very, very low while the chances of a bank defaulting on a bond are still low, but less low.

The other key factor is the bond’s maturity date. This is the date at which the bond is repaid at par value. As there is a secondary market for bonds you can buy and sell bonds with other investors before their maturity date which, in-turn, effects the running yield of the bond.

In order to understand how the secondary market for bonds can influence the running yield you need to understand how the running yield is calculated. You simply divide the annual coupon payment by the current market value of the bond.

Running yield = annual coupon / bond market value

If interest rates rise, the market value of a bond will fall as the return investors can get on their cash has increased. When the market value of the bond falls, the running yield will rise. If interest rates fall, the market value of the bond will rise as the return investors can get on their cash has reduced. This will reduce the running yield.

As a bond gets closer to it’s maturity date, the market value of the bond will get closer and closer to it’s par value despite interest rates as investors anticipate the bond will be paid out at its par value.

Where do bonds sit on the risk ladder?

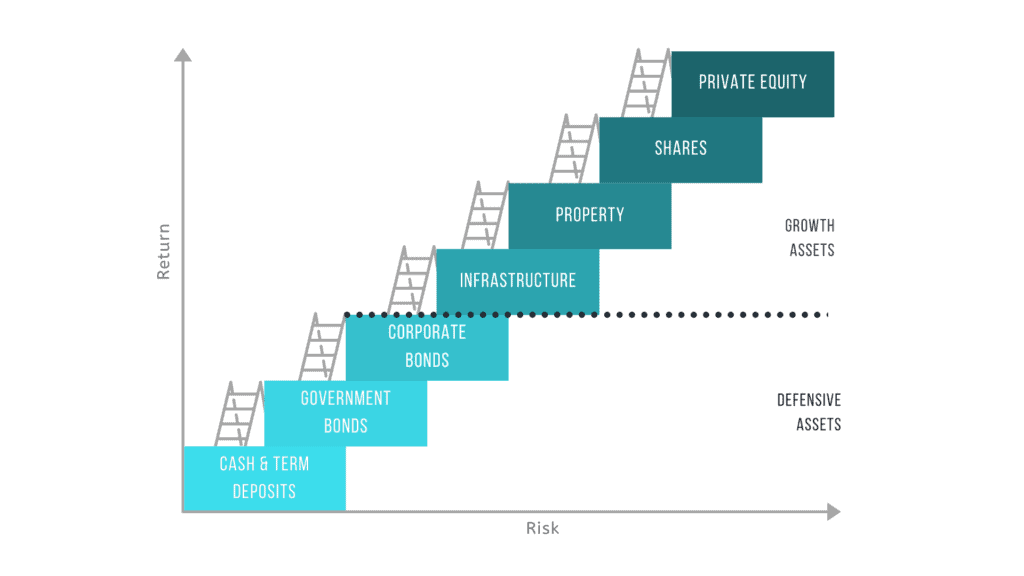

When assessing the risk/return trade-off of any investment when tend to consider where it sits on the “risk ladder”. This compares the risk of an asset class with its potential return. When there is more risk, there is more volatility and we expect a better potential return.

The risk ladder can vary slightly, depending on who you ask and which country you live in. My version of the risk ladder looks as follows:

As you can see from the image above, both government and corporate bonds are a relatively low risk, low return asset class. You can expect a little variation in their market price due to the secondary market for these bonds but if you buy quality bonds, with little risk of default, then you know that by holding the bond to maturity you can get back the par value of your bond.

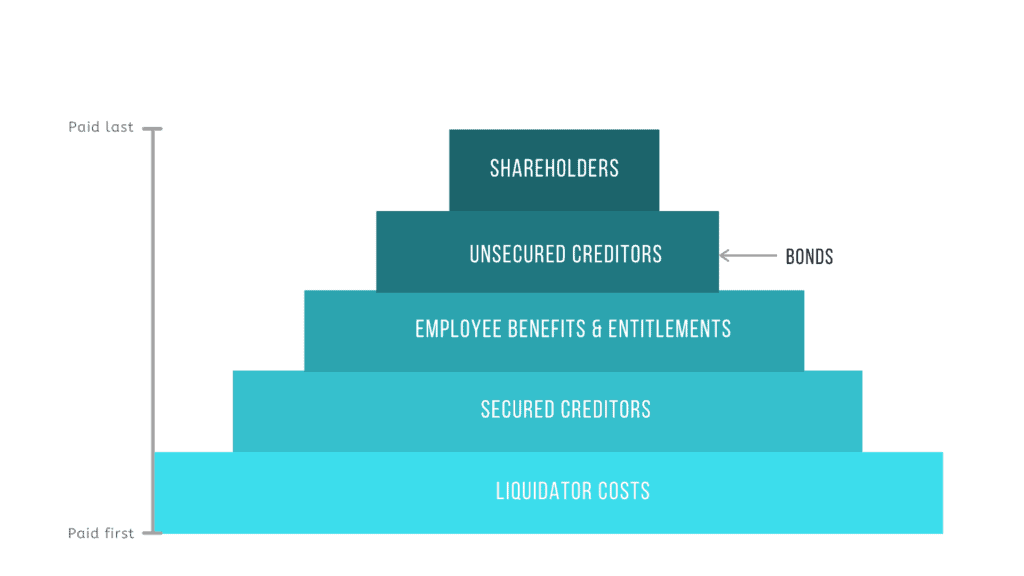

Attributing to the low risk nature of bonds is where they sit in the priority of liquidation relative to shares. This is illustrated below.

As a corporate bond holder, if the issuer of the bond goes into liquidation, you will be paid out before shareholders. Put simply, if a company fails you will be more likely to recoup some, or all, of your investment if you own bonds in the company as opposed to shares in the company.

However, as with all asset classes bonds do come with risks which need to be considered. The risks are as follows:

- As we already discussed, there is a secondary market for bonds. This secondary market causes bonds to trade at a premium or discount to the bonds par value. As a result, there will be fluctuations in capital value of your investment. This fluctuation is normally much less significant than shares.

- Bonds are sensitive to interest rate changes. A change in interest rates will impact the market value of your bond. This can be mitigated to an extent by floating rate bonds which we will discuss in the intermediate guide to bond investing.

- The purchasing power of a bond’s coupon payments are going to be impacted by inflation, particularly in bonds with a long maturity date. If inflation is high, your purchasing power reduces and this will likely lead to higher interest rates which is all negative for bond prices.

- If you buy individual bonds you may be subject to liquidity risk. That is, you cannot find a buyer for your bond holding in the secondary market. Liquidity risk can be overcome to an extent by using bond funds as I will discuss later.

- When you buy bonds you run the risk that the bond issuer is unable to make interest or principal obligations and therefore default. This is known as credit risk. You should always look to buy bonds in governments and companies which have strong balance sheets and good cash flow.

Despite these risks, for me bonds still sit in the defensive part of your portfolio. Defensive assets are ones which give you a good “sleep well at night” factor because there is little risk of your capital disappearing. The return from bonds isn’t amazing but you do get a margin of income above what you would get from a savings account.

How to buy bonds.

With all asset classes I invest in, I like to take a diversified exposure. Bonds are no different. Instead of buying individual bonds I would suggest using either a passive or active bond fund. This will allow you to get a broad exposure to a number of bonds with a single holding.

There are many ways you can buy bond funds including exchange-traded funds (ETFs), managed funds, listed investment companies (LICs) and mFunds. I typically use ETFs and LICs due to their accessibility.

In order to buy a bond ETF or LIC you simply buy it on the Australian stock exchange (ASX) like you do any other shareholding. All you will need is an online broker account.

In the intermediate guide to bond investing I will delve into the differences between ETFs and LICs when investing in bonds and outline my preference.

Final thoughts.

When you buy quality bonds they are a great asset class to serve as a store of wealth which gives you a slightly better return than cash. There are some risks to consider before investing in bonds but I do believe the risks are manageable and bonds can comfortably be considered a defensive asset.

For younger people, with a long investment time horizon, bonds are not going to provide you a great long-term return. They can be used in an accumulators portfolio as a short-term store of wealth while you wait for an opportunity in equity markets but they shouldn’t take the place of equities in the long-term.