When it comes to investing in physical property there are a huge number of factors you should take into consideration – everything from how a property is going to fit in with your personal financial situation from a tax and cash flow perspective to the macro-economic and political factors that may influence property prices.

All of these factors are important, and need to be considered, but today I want to discuss one factor in particular. Something I believe creates long lasting value in a property. Before I jump into it, you first need to understand the breakdown of how a property is valued.

When you buy a property you can essentially split the value of that property into two parts; the value of the land and the value of the house that sits on the land. From an investment perspective, it is the land that is important.

Over time, the land appreciates in value. The house on the other hand, will depreciate. That is why I always encourage people to try to buy a property that holds most of its value in the land and not the house. Buying a new house is a bit like buying a brand-new car – the depreciation will eat into your wealth over time. This is also why I would never buy an apartment because essentially you are only buying some nicely arranged bricks.

So now that we understand that the land is the valuable part of a property, how do you ensure you buy the right piece of land? The answer is simple – scarcity.

For me, scarcity is potentially the most important factor to consider when buying a house as scarcity creates value. If you think about it, this rule applies to many asset classes.

Take gold for example, a chunk of gold is fairly useless to the average person but everyone wants it. Why? Because of the value it holds! The only reason that gold holds value is because it is rare. If everyone could dig in their back yard and find a chunk of gold then it would no longer hold value as it would have lost its scarcity.

Going back to property, and more specifically land, scarcity in the location of your property will be a key driver of your property value over time. The key drivers of scarcity in property that I look for include:

- Distant to the central business district (CBD);

- Distance to natural resources such as the ocean or river;

- Distance to infrastructures such as schools, parks, highways, etc.

All of these areas are highly sought after and have limited space available. If you can find a property that ticks multiple boxes, you are onto a real winner! Let me give you an example.

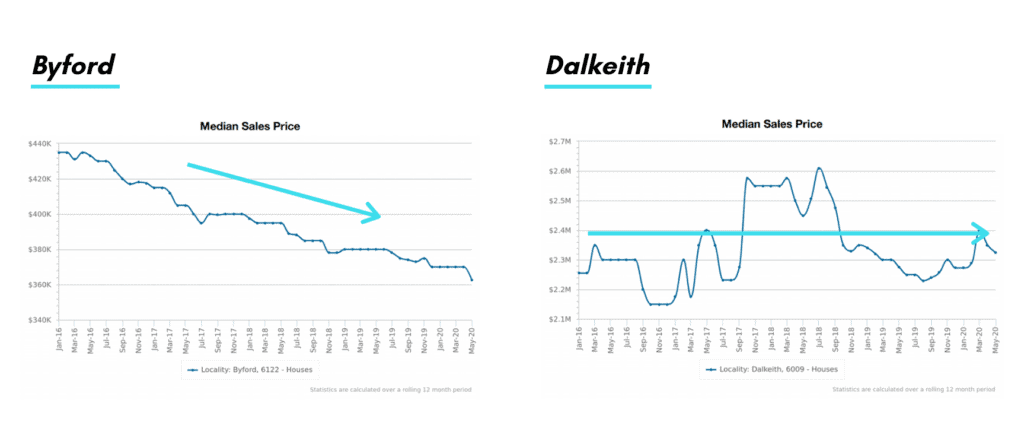

Here in Perth, our most expensive suburb is Dalkeith with a median house price of $2.29 million. If we look at where Dalkeith is on the map, its bang on the river, a stone throw from the ocean and a short drive to the CBD – tick, tick, tick!

If the property market goes through a downturn, these scarce properties will still feel the impact of that downturn but to a lesser extent. There will always be some level of demand for these rare properties from both a buying and renting perspective.

On the other hand, if you purchase a house in a remote location then the land is not scarce – there is plenty of it available. Let’s take Byford for example which is another local Perth suburb. Byford is essentially in the middle of nowhere. If we compare the trend of the median house price between Byford and Dalkeith over the last few years, you can see a notable difference.

Now obviously these charts are not gospel as there can be many factors impacting the median sales price such as reducing block sizes. However, in my opinion, the key problem with Byford is that new subdivided blocks of land are getting released regularly because there is so much land available out there.

Now obviously scarcity is a great thing to have but you also have to work within your budget. Most people can’t afford to buy in suburbs like Dalkeith but you can apply these same principals within your means.

When I purchased my first house, I understood the value of scarcity so I drew a circle of all the houses within 15 kilometers from the CBD. I then eliminated all the suburbs that didn’t fit into my price bracket and was left with a list of suburbs that I could afford to buy in. Of those suburbs left, I added on my second level of filters which included things like local infrastructure, proximity to family and friends, etc.

My first home was not my ideal house, but it did fit my requirements at the time and because it ticks the scarcity box (somewhat) I intend to keep this house for the long-term as I believe the land will appreciate in value.

When I purchased my second house, I went through the same requirements but this time my budget was bigger so I was able to get close to both the CBD and the beach.

So, when you are buying a property just keep in mind that it is the land that is valuable and the location of that land will be a key driver of the property’s value. Having a nice house on the land is a luxury and, if you can afford that luxury, then great! But from an investment perspective, you should always prioritise land over house.