Following on from my previous blog on Wills, we are now considering how the payment of a death benefit from superannuation fits into your estate plan. With roughly $2.9 trillion invested in super throughout Australia (and growing!) getting the right nomination on your super fund is crucial.

The payment of death benefits from superannuation can be quite a complex area of advice as there are different methods of paying a death benefit and tax implications may apply. So, while I am going to attempt to keep this as simple as possible, forgive me if I stray a little into the realm of complexity and leave you scratching your head.

So grab yourself a coffee, switch your brain into thinking mode and let’s get started.

What makes up your death benefit payment

Your superannuation death benefit will be made up of your accrued super balance plus any life insurance benefit you may hold through super.

You direct who receives this benefit in the event of your death via a nomination of beneficiary. If you chose to nominate an individual person(s) then this death benefit payment does not form part of your estate – payment is made directly to the nominated beneficiary.

Consider who is a dependant

The first thing you need to do is to consider who can receive your death benefit and for that we look to the Superannuation Industry (Supervision) Act (SIS Act).

A superannuation death benefit can only be paid to someone who is classified as a dependant under the SIS Act. In addition to the SIS Act, you should also consider who is classified as a dependent under the Income Tax Assessment Act (ITAA) as this will determine if there is any tax payable on the death benefit (more on this later).

Ideally, you are looking for someone who is classified as a depend under both acts as this will mean they are eligible to receive the payment and no tax will be payable (if paid as a lump sum). This includes your spouse, child under the age of 18 or a person whom you are in an interdependency relationship with, i.e. you live together and provide each other financial, domestic, and personal support.

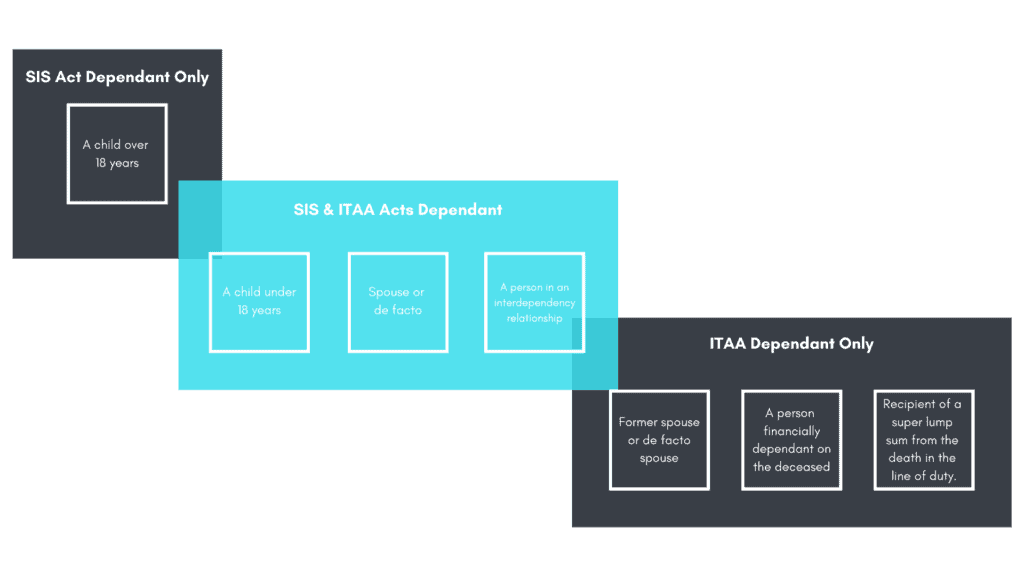

The diagram below illustrates the overlap and differences between the SIS Act and ITAA ACT.

As you can see from the diagram above, a child of any age is a SIS dependent but only a child under the age of 18 is a tax dependent. A former spouse is considered a tax dependent but only a current spouse is considered a SIS dependant. This means you could pay the benefit to an adult child with tax penalties, but you couldn’t pay the benefit directly to a former spouse.

If you don’t have any dependents under this SIS Act, your superannuation will be passed onto your legal personal representative which is the person who will be administering your estate, ie the executor of your will if you have a will.

Payment of death benefits

A death benefit can be paid as either a lump sum or, in some instances, an income stream. Where the deceased member’s super balance is not currently in pension phase, in order to receive the benefit as an income stream, the beneficiary must be a SIS dependant, including:

- Spouse or de facto

- Financial dependent

- Interdependent relationship

- Child under 18

- Child aged 18 to 25 and is financially dependent

- Child that is permanently disabled.

Where the death benefit is paid as an income stream to child under the age of 18, the income stream must be commuted to a lump sum when the child reaches age 25, unless they are permanently disabled.

If the death benefit is being paid from an existing superannuation income stream, such as an account-based pension, it may continue to be paid to a reversionary beneficiary if one is nominated.

Please be aware that any time a death benefit is paid as a pension, you need to consider the transfer balance cap (TBC) of the recipient. Every person has a TBC of $1.6 million (this will index in future years by $100k increments in line with CPI). The death benefit income stream must be within this limit and there are special rules around TBC for children.

If the beneficiary already has an existing pension, and subsequently their own transfer balance account, there must be sufficient space left in the TBC in order to receive the death benefit as an income stream. If not, it will need to be paid out as a lump sum.

Taxation of benefit payments

Whether or not a death benefit is taxable will depend on how the payment is made (lump sum or income stream) and if the beneficiary is classified as a dependant under the Income Tax Assessment Act (ITAA) as we touched on previously.

Just to recap, dependant under ITAA includes:

- Spouse (inc. de facto partner) or former spouse;

- Child, aged less than 18;

- Any other person with whom the deceased person had an interdepency relationship with just before he or she died; or

- Any other person who was a dependent of the deceased person just before he or she died.

If a payment is taxable you also need to understand the components that make up a super fund to calculate the tax payable. There are three components that can potentially make up a super balance as follows:

- Taxable Taxed. Derived from concessional contributions and investment returns.

- Taxable Untaxed. Derived from some death benefit insurance payments and money from an untaxed superannuation scheme like GESB West State Super.

- Tax-Free. Derived from non-concessional contributions, government co-contribution, low-income super contributions, eligible spouse contributions, contributions under the small business CGT concessions and contributions relating to personal injury payments.

All super funds will be made up of one or a combination of these components. For most people, their super will be primarily taxable as this is derived from employer superannuation guaranteed contributions (SGC).

So now that we understand who is a dependent under ITAA and the components that make up a super balance, we can now consider the tax implications under differing scenarios.

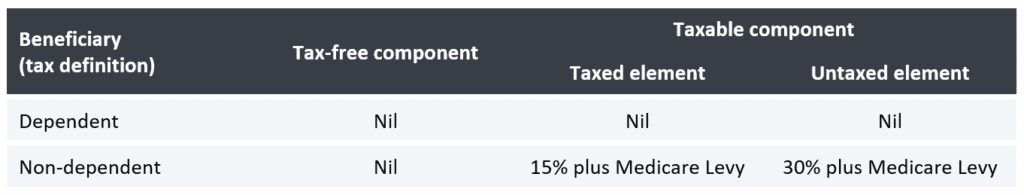

The table below summarises the tax treatment of a lump sum payment:

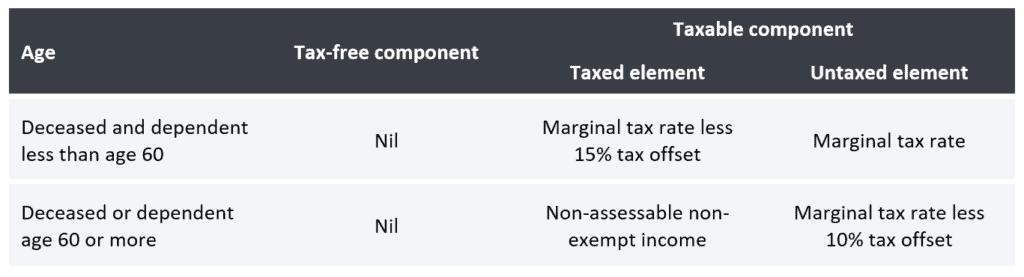

The table below summarises the tax treatment of an income stream payment. Please remember that a death benefit income stream cannot be paid to a non-dependant:

In summary, the tax-free component of your super fund will always be paid out tax-free to a beneficiary whether they are dependent or not and regardless of whether it is paid as a lump sum or income stream. The tax treatment of the taxable component, will vary depending on the relationship to the deceased and how the benefit is paid.

Given the very favorable tax treatment where the deceased is age 60 or more, reversionary nominations are a very popular choice where an existing pension account has been started. More on this type of nomination later.

Where the trustee of a deceased estate receives a lump sum superannuation death benefit, it is taxed in the hands of the trustee according to whether a dependent or non-dependent is expected to receive the benefit.

Nominating a beneficiary

By nominating a beneficiary you are instructing the trustee of your super fund as to whom you would like to receive your death benefit if you were to pass away.

When it comes to nominating your beneficiary you normally have a few different options. It is important you understand these options because the type of nomination you choose can give you greater control over how your super benefits are distributed.

The three main types of nominations are as follows:

- Binding nomination. As the name suggests, a binding nomination is binding to the trustee provided you have met all the legal requirements. Binding nominations can generally be both lapsing and non-lapsing. If it is a lapsing, binding nomination it will automatically expire every 3 years and you need to renew it. If it is a non-lapsing, binding nomination it will not expire.

- Non-binding nomination. If you make a non-binding nomination this is an indication to the trustee as to whom you would like to receive your funds but ultimately the trustee has final say over the distribution. If the trustee feels your non-binding nomination is not appropriate, they can pay it out to a beneficiary whom they believe has a better claim to the money.

- Reversionary nomination. If you have a pension account established, you can list a reversionary nomination. Under this arrangement, the pension account will continue to operate but ownership will be transferred to the nominated beneficiary. This is particularly useful if you want to keep the funds held in the tax-free pension environment. Just remember there are transfer balance cap limits to take into consideration with this style of nomination.

So, the type of nomination you use will depend on your family situation and whether you are in pension or accumulation phase. When making the nomination you can name the individual person(s) or you can list your legal personal representative (your estate).

If you fail to list a nomination of beneficiary then the decision as to whom receives your death benefit is up to the discretion of trustee of the super fund. Generally, they would pay the benefit to your estate however they can, if they chose, nominate an eligible beneficiary. Best to nominate a beneficiary yourself to avoid this ambiguity.

Final thoughts

Nominating a beneficiary is an important aspect of estate planning that often gets neglected but it is so important! As with all estate planning issues, it is not about making your life easier it is about looking after the ones you care for in the event of your death.

In order to nominate a beneficiary you need to contact your super fund and ask for the appropriate paperwork to complete in order to make the nomination. If you are still unsure as to whom you should list, what type of nomination you should make and what the tax implications might be, then I would suggest seeking professional advice. Moving forward, if there is a significant change in your situation you should review your nominated beneficiary along with the other components of your estate plan.