Sometimes as a Financial Adviser I can get carried away with the complex stuff like focusing on tax minimisation strategies, investment allocations, super contributions and so on. But the reality is, a strong financial position is built off the back of the basics. One of these fundamentals is your account structure.

When it comes to taking control of your finances, having an appropriate account structure can be the backbone of your success. It will help you track, manage, allocate and automate your cash flow in line with your financial plan.

Why your account structure is so is important

To build meaningful wealth, you need to know your personal profit and loss statement. That is, what money is coming in and what money is going out. This refers to the ability to track your cash flow.

For this to be effective, you need to be able to track your cashflow at a glance. Within 2 minutes, you should be able to know if your cash flow is on track. If it takes longer than this, the inherent laziness of our human nature will mean that you won’t do it, or at best, you won’t do it often enough.

An effective account structure will allow you to track your cash flow easily, without the need of spreadsheets or budgeting apps.

By easily tracking our cash flow, you can then better manage it. You can tell, at a glance, if you are spending too much or if you have surplus.

If your expenses are too high, you can make adjustments and drill down into the root cause of your excessive spending. Maybe it was something unexpected, an anomaly, or maybe it is a regular spending habit that needs to be addressed. Either way, you need to be able to track it in order to manage it.

Hopefully, by tracking your cash flow, you realise that you are in surplus. You then need to allocate that surplus appropriately. It is your net cash flow (the difference between earnings and spendings) that can will be allocated to help build wealth.

Without allocating your money, and telling it where to go, it often disappears. We spend it on meaningless items or consumption that brings us, at best, some short-term comfort or enjoyment.

On the contrary, by allocating your cash flow efficiently, you are building good financial habits which will have a compounding effect on wealth creation that, by itself, will put you ahead of the average person. The best bit, your allocation can be done automatically!

In order to make meaningful changes to your financial position, you need to be doing the right things consistently over time. Motivation can help you get started on this journey, but without the appropriate systems in place, you will likely stray from the plan.

Automation will keep you on track. It takes some work initially to set up the process, but then it will run its magic without any input from you. You are much more likely to succeed in your financial goals, no matter how far-reaching they may be, with automation on your side.

Now that we understand the importance of a well-structured account setup, lets dive into the mechanics of it.

Setting up accounts

When it comes to setting up your account structures, I know a lot of people like to create a complex web of accounts, itemising each account for each purpose. Not me. I find this hard to follow and frankly, unnecessary.

I like to keep it simple. Simple is often best! But your account structure can be as unique as your fingerprint. This means that if you like to have different accounts for different purposes, then by all means, go for it!

I am going to show you how to setup an account structure that suits your individual circumstances. There are two accounts which I believe are fundamental to everyone’s situation and then you can continue building from there, creating additional accounts to suit your need and method of managing finances.

The first account you are going to need is a transaction account.

Transaction account

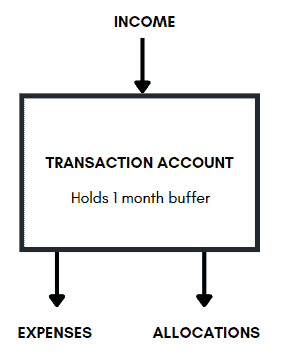

As the name suggests, your transaction account is going to facilitate the flows of money. Its where income comes in and outflows go out. Think of it a little bit like your heart – it pumps money around your financial system to where it needs to go.

Outflows are made up of two items – expenses and allocations. Let’s talk about expenses first.

The expenses which come out of your transaction account include loan repayments, food, groceries, rent, entertainment, school fees, and any other regular or small expense which pops up.

Also coming out of the transaction account are your allocations. This is any money which is purposefully allocated for wealth building. This may include additional debt repayments, investments, super contributions, etc.

For example, if you intend to put an extra $200 per week onto your home loan, it will come out of your transaction account. If you intend to invest $1,000 per month, it will come out of your transaction account.

The only items that won’t come out of your spendings account are ah-hoc expenses which you have purposely saved for. For example, a new car or a big holiday. These are not regular nor small expenses, so they will be funded from savings.

The amount of money that needs to go into your spendings account each month is going to be dictated by your budget. By preparing a budget, you should have a good idea about what you need to spend each month.

At the end of each month, you should always have one month’s expenditure left in your transaction account. For example, if your budgeted outgoings are $5,000 per month, then at the end of each month you should have $5,000 left in the account.

I recommend always retaining this buffer in the transaction account because expenditure isn’t perfect. It’s not a set amount, exactly the same each month. It varies from month to month. Some months you may spend more which can be made up by months where you spend less. Either way we need the buffer to ensure you don’t overdraw your account!

Over a three-to-six-month period, you want to see that the account balance at the end of each month averages out to approximately one month’s outgoings. If it’s less, you need to review your outflows and determine if you are spending too much and adjust your expenditure accordingly. Or maybe your budget wasn’t viable, and you need to allocate more money to certain items.

If you don’t currently have any savings, and you are living pay to pay, then your first financial goal should be to save up the one month’s buffer in your transaction account.

In summary, your transaction account looks like this:

Savings account

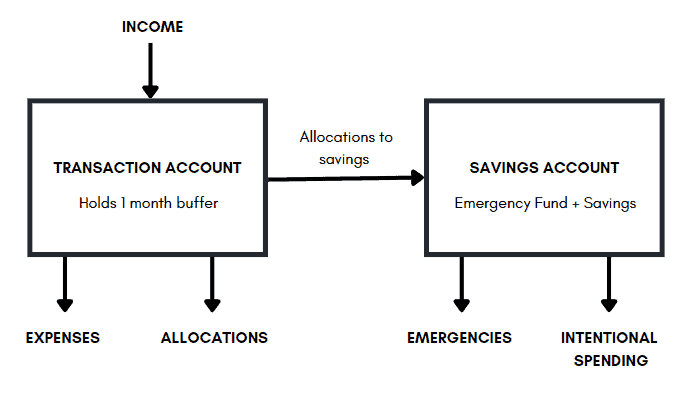

Your savings account is going to be a combination of your emergency fund (more on this in Step 5) and any additional savings you have for other reasons.

Any time that you take money out of a savings account it should be done consciously. That means no tap and pay from your savings account. In fact, you shouldn’t even have a card to access your savings account.

If money comes out of savings, it needs to be done so intentionally. For example, maybe there is an emergency and you lose your job; you can dip into your savings to fund expenses while you are looking for new work. Or maybe you are going on a holiday that you have saved up for; you can dip into your savings for that holiday.

If you are dipping into your savings to top up your spending account, then you need to review what went wrong. Are your spendings too high or is your budget too tight. In the latter, you will need to reset your budget and adjust the monthly amount that goes into the spendings account accordingly.

Once you have your one-month expense buffer established in your transaction account, your next goal is to build your savings account. This will be done by allocating surplus cash flow from your transaction account into your savings account.

The level of money you are aiming to accumulate in your savings account is a minimum of 3 months of expenses. This is your Emergency Fund (we will talk about this in detail in Step 5) and is very important both emotionally and financially. If your savings account is ever below this point, you need to shift surplus cash flow from your transaction account into your savings accounts to top it back up.

There is no ceiling on the amount of cash you can hold in savings. If you have a large upcoming purchase, like a car, you might be holding an additional $30,000 in cash on top of your required emergency fund.

If you have a mortgage, then your savings account should ideally be an offset account – I love offset accounts! In my opinion, they are the best product offered by banks. If you’re not aware of what an offset account is, let me give you the quick gist of it…

You can think of an offset account like a high interest savings account but instead of generating you interest, it saves you interest. It does this by using your savings to offset your loan balance, thus reducing the interest payable.

For example, if you have a $400,000 loan linked to an offset account with $50,000 in savings, you only pay interest on the difference between the loan balance and the offset balance, which in this example is $350,000.

This is better than any high interest savings account that generates interest (rather than saving it) because banks work on what’s called a net interest margin (NIM). The NIM is the difference between the interest rate banks give out on deposits vs what they take in on loans.

For a bank to remain profitable, its NIM has to be positive which means the amount they generate on loans has to be more than the amount they give out on deposits. As a customer of the bank, this means you will never generate more interest in a savings account than you can save by using an offset account. There is also the added bonus that interest saved is not taxed but interest generated is.

In summary, if you have a mortgage, your savings should be in an offset account if one is available to you. Just be aware, there will likely be a fee associated with having an offset account (banks normally put you under a “package”) and you generally can’t have an offset account against a fixed loan (although there are a few lenders that allow this). If your particular lender allows multiple offset accounts (some do) then ALL of your accounts should be offset accounts.

If you don’t have a mortgage, then a high interest savings account is the next best thing. Just be aware that if you are holding over $250,000 in cash (which is unlikely in Phase 1 of building your wealth) then you may want to spread your savings across multiple deposit takers to ensure you are covered under the Australian Government Financial Claims Scheme (FCS).

Under this scheme, deposits of up to $250,000 are protected by the government provided you are with an authorised deposit-taking institutions (ADIs). You are only covered for up to $250,000 per ADI so if you have more than this, you may wish to spread some cash across multiple ADIs.

Now that we have introduced the savings account into the mix, your set up should be starting to look like this:

This is the fundamental account structure which applies to everyone. From here, you can start to get a little creative and add on structures to suit your particular situation. Let’s consider some of the additional account structures now.

Credit Cards

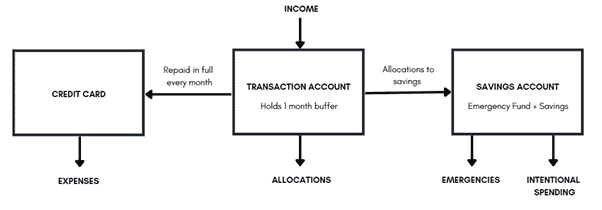

If you want to use a credit card to fund your expenses in order to get points, then I am okay with that! In this instance, you would put your expenses on the card and pay out the balance at the end of each month from the money in your transaction account.

Just be careful that you don’t use your credit card as a means to spend more than you should. You should never carry a balance on your card. It needs to be paid out each month, before interest is accrued. If you can’t do that, don’t use a credit card no matter how good the frequent flyer points may be!

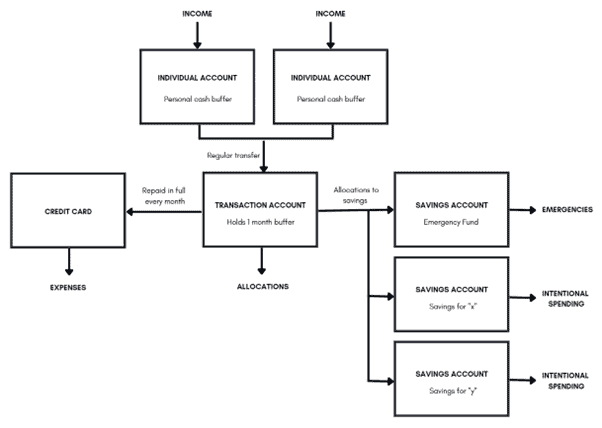

With the addition of a credit card, your account structure will look like this:

Multiple savings accounts

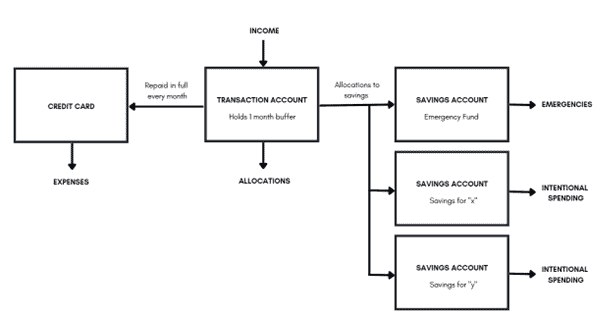

When it comes to saving for a planned expense, I personally like to accrue my savings on top of my emergency fund in the sole designated savings account. However, I realise this doesn’t work for everyone.

Some people like to have separate savings accounts for separate purposes. For example, you may have one savings account for your emergency fund, a second for a holiday and third for a new car purchase. There is nothing wrong with this approach!

If having multiple savings accounts lets you track, manage, allocate and automate your cash flow better, then by all means go for it. The only thing I would say is – prioritise the emergency fund first.

Like we discussed previously, you shouldn’t create a savings account until you have your one-month buffer in your transaction account. Once you have achieved the one month’s buffer, your first savings account should be your emergency fund. Once your emergency fund has been established (minimum of 3 months expenses), only then should you consider creating additional savings accounts for different purposes.

Ideally, all savings accounts will be offset accounts (if you have a mortgage). If you can only have one offset account, choose the account with the largest balance to be the offset.

With the addition of multiple savings accounts, your account structure will look as outlined below. Please note, I have only shown two additional savings accounts, for purposes “x” and “y” however, you can have as many as you like!

Joint accounts with your partner

If you are in a serious, long-term committed relationship and you are on this financial journey together, then it makes sense to set up your account structure with your partner.

Some couples like to share every dollar, in which case your account structure doesn’t really change from what we already discussed. The only difference is, the transaction account would be held in joint names and the savings account(s) would either be held in joint names or, where it is a high interest savings account, in the name of the spouse with lowest marginal tax rate. This will help minimise tax payable on interest earned.

My wife and I personally prefer to have some financial independence from each other. This allows us to make small purchases without the need to consult one another, buy gifts for each other off our own backs and have a little financial independence.

Majority of our money is pooled, as we are both working towards the same financial goals, but we like the freedom that comes with having our own stash of cash. After all, relationships can be challenging enough without arguing about how your better half is buying 6 cups of coffee per week and you are only buying 2. If they are buying 6 cups out of their own money, power to them!

If you are like us and want that little bit of financial independence from each other, then you would both have your own personal transaction accounts which receive income and decide, as a couple, how much you transfer each week/fortnight/month into the joint pool.

If there is a significant earnings discrepancy between the two of you, it is okay for one person to transfer more than the other. If one person doesn’t work at all (happens often when starting a family), then you should think about setting up a regular transfer to that person from the joint transaction account to give them some financial independence. All of this needs to be worked out, and agreed upon, in an open discussion.

With the inclusion of individual accounts, your account structure will start looking as follows:

Business Account

If you run a business, you will definitely need an additional account set up. Your business income and expenses should always be managed separately to your personal finances to simplify your tax reporting and allow you to better track/manage your business cash flow.

The business account should be owned by the structure that runs the business. Therefore, if you operate a business as a sole trader, the account will be in your personal name. If you operate the business through a company, the account will be in the company’s name. If you operate the business through a trust, the account will be owned by the trustee as trustee for the trust.

You should then have a plan for how the business account interacts with your personal accounts. For example, how much income are you going to draw down from your business? I won’t go into this in too much detail as operating a business is something that we discuss in Phase 2 of wealth creation.

You can also consider setting up a “business account” if you own an investment property. Even though this is not a business, the principal is the same. By using a single account to receive the income generated by the property and pay for all the property related expenses, it makes it much easier to track come tax time.

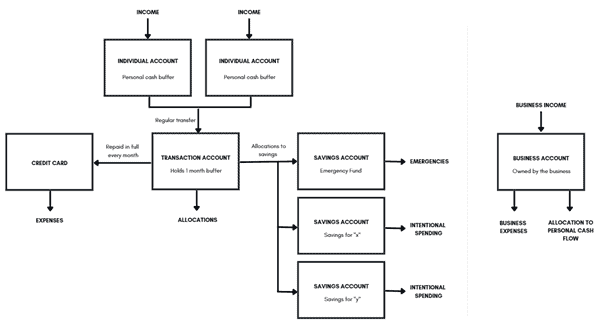

With the addition of a business account, your account structure will look as follows:

As you can see, your account structure is starting to get pretty involved! However, please remember that majority of these accounts are optional. It is only the core transaction account and the core savings account that are fundamental to your success. The additional of all the other accounts (aside from the business account if it is applicable) are optional and should only be used if they help you to track, manage, allocate and automate your cash flow better.