our mission

Everyone knows they could be doing more to improve their financial position but due to either lack of knowledge or procrastination, nothing changes. Years go by, money comes and goes, but you still find yourself trapped in your 9 to 5 as you can’t afford to leave.

We help people break the cycle by educating them on how to build and protect wealth. Our primary focus is on helping clients achieve financial independence so they can unlock all of life’s possibilities.

Advice your way

Take your finances to the next level with a comprehensive financial plan, tailored to your individual needs. We build out your full financial road map for you.

Have a few questions you want answered but don’t need a comprehensive financial plan? Ask an Adviser is a one hour zoom meeting to answer your specific questions.

areas of advice

Building a financial plan is a bit like baking a cake; you need all the right ingredients mixed in the right order. Your financial plan needs to be tailored to your own needs with the right ingredients.

FINANCIAL CALCULATORS

Our free financial calculators are handy tools to use on your journey to financial independence.

Investment Property Projection

Model the purchase of an investment property on cash flow, net asset position, tax and more.

Financial Independence Calculator

Calculate the amount of investable assets you need to achieve financial independence.

Loan Repayment Calculator

Calculate your minimum repayment and the benefit of your additional repayments.

STRATEGY LIBRARY

Immerse yourself in wealth creation strategies specifically designed to help Australian’s achieve financial independence.

Family trusts explained

Investment-Linked Lifetime Annuities Explained

Emergency Fund Explained

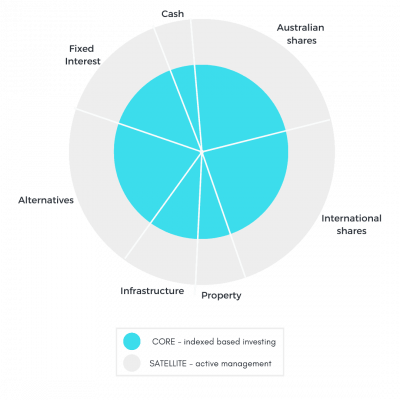

Portfolio methodolody

Using a collective of expertise, we build, monitor and manage portfolios that last the test of time using the Core + Satellite approach to investing.

The asset allocation is tailored to your investment timeframe and risk tolerance to give you a portfolio outcome that you are comfortable with.

Risk Mitigation

Protecting your financial position in the event of injury, illness, disablement or death is a crucial consideration in any robust financial plan. This is where Life, TPD, Trauma and Income Protection may come into play.

We complete a detailed needs analysis to determine the cover required, quote the market to find the most competitive policy and have it structured tax effectively.

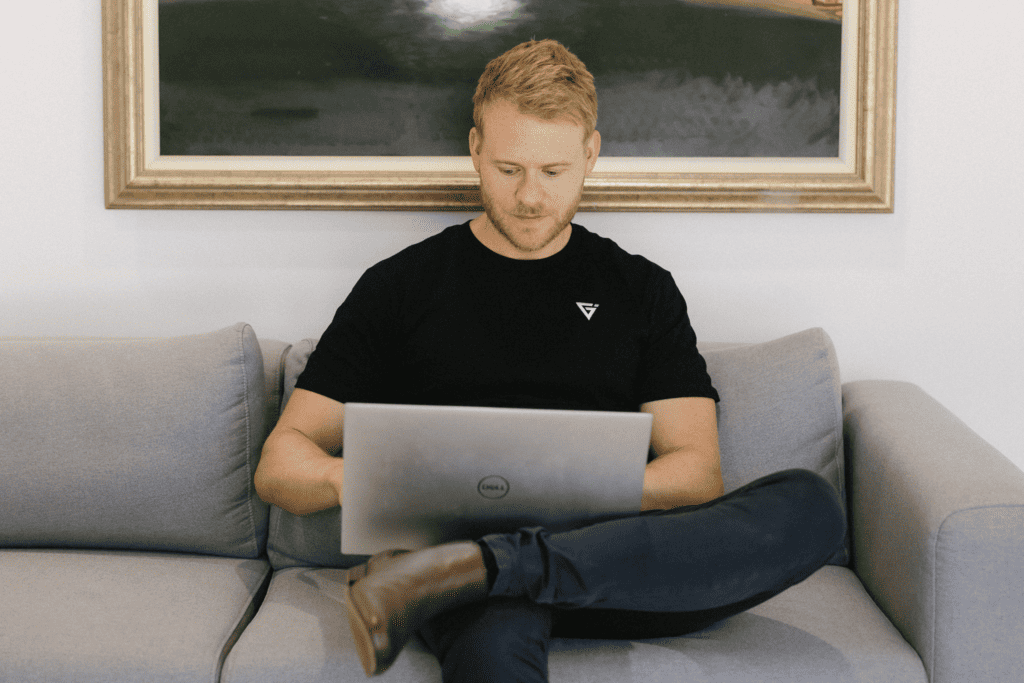

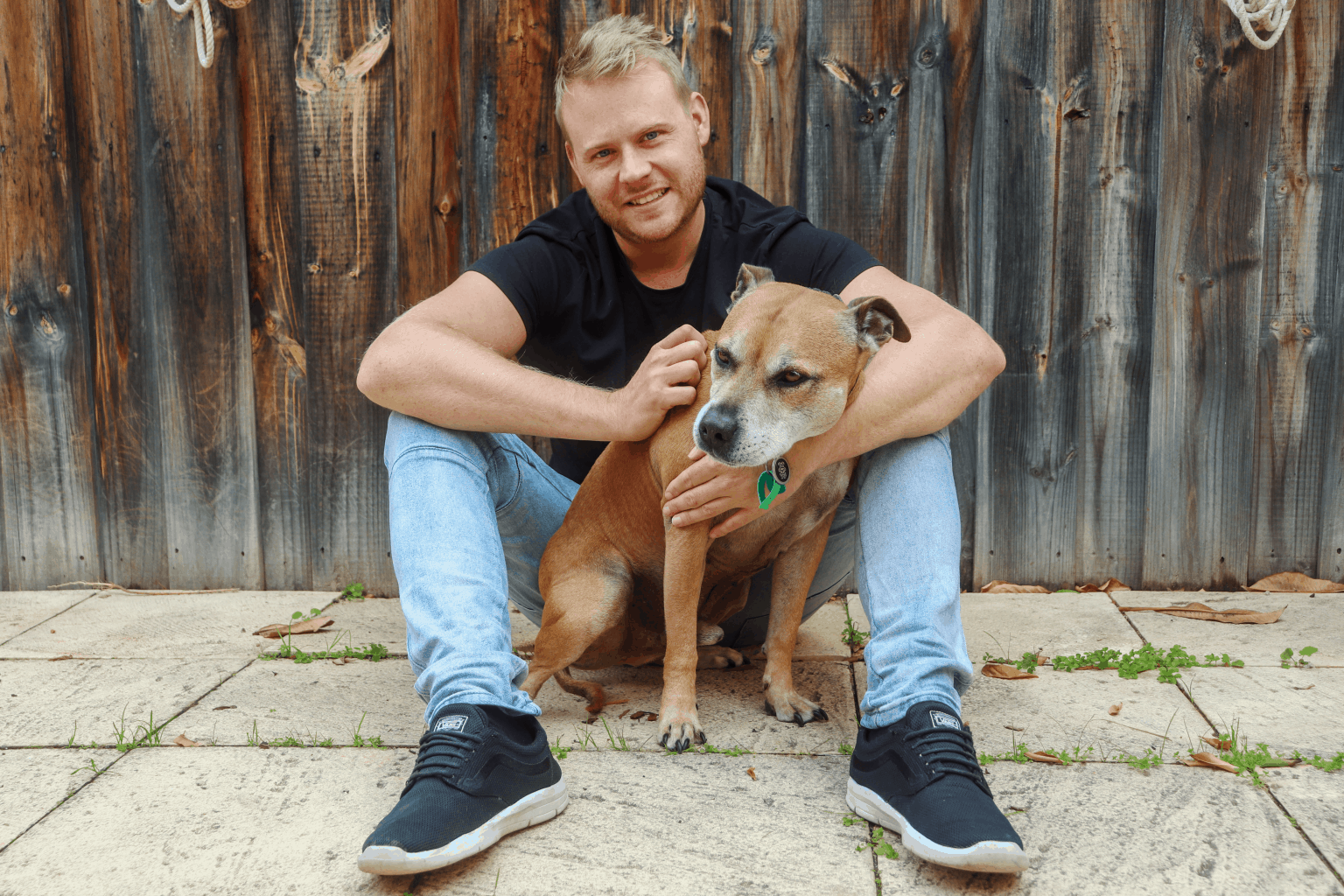

meet brad

Hi I’m Brad, founder of the Guided Investor. I started in the financial advice industry in 2007, with a passion for helping Australian’s achieve financial independence.

Guided Investor isn’t your typical financial planning practice. We take pride in the education and resources we offer all Australian’s to empower them on their journey to financial independence.

Brad Buters

Managing Director | Financial Adviser

Hi I’m Brad, founder of the Guided Investor. I started in the financial advice industry in 2007, with a passion for helping Australian’s achieve financial independence.

Guided Investor isn’t your typical financial planning practice. We take pride in the education and resources we offer all Australian’s to empower them on their journey to financial independence.

Debt

Investing

Investing

Tax

Retirement

In the loop

Join our mailing list to keep up with the latest. Oh and don’t worry, we don’t spam our friends! Just useful information to help you on your financial journey.

See what others are saying

We are proud of the work we do and are eternally grateful for those clients that take the time to share their experience of working with us.

Trustindex verifies that the original source of the review is Google. Highly recommended, professional, methodical and supportive. Brad understood our long term goals, he provided us with a clear road map with options. We found Brad to be knowledgeable and passionate about his work. Bonus, he's a pleasant guy !! easy to talk to. We found Brad on youtube, we were immediately impressed by his presentation. "Guided Investor"Trustindex verifies that the original source of the review is Google. Brad has shared a wealth of knowledge with us. Being FIFO I was stuck as where to go to next with my financial situation. Great advice on what I can do and if I am on the right track to be able to retire comfortably. Down to earth and easy to talk to.Trustindex verifies that the original source of the review is Google. Brad Buters has been brilliant to work with. I have a rather unique financial situation and Brad was able to provide financial advice and build a financial plan that worked for my situation. He was extremely detailed, explained everything in a way that I could understand and was able to provide exceptional guidance. I highly recommend Brad and Guided Investor. He is so knowledgeable and responsive to all things financial. Thank you, Brad!Trustindex verifies that the original source of the review is Google. Brad has provided us with great advice. He is very knowledgeable and provides holistic approach that is tailored to your circumstances. Highly recommended. ⭐️⭐️⭐️⭐️⭐️Trustindex verifies that the original source of the review is Google. Brad is very insightful. His way of explaining things is very easy to understand. I really enjoyed getting Brad to answer my questions and discuss my potential financial options for my situation. I would use him again for financial advice in the future.Trustindex verifies that the original source of the review is Google. I can't recommend Guided Investor and Brad Buters highly enough! From the moment I started working with Brad, I knew I was in good hands. He is not only incredibly knowledgeable about all things finance, but also incredibly personable, making even the most complex financial topics easy to understand. Brad took the time to listen to my unique goals and concerns, and tailors his advice accordingly, ensuring that my financial strategy is perfectly aligned with my needs. What sets Brad apart is his ability to communicate clearly and effectively. Whether through phone calls, emails, or meetings, he is always prompt, patient, and thorough. I’ve never felt rushed, and Brad always ensures that I am comfortable with every decision before moving forward. His communication style is warm and professional, making me feel truly valued as a client. Working with Brad and Guided Investor has been an incredibly positive experience. His expertise combined with his personal touch has not only helped me make informed decisions but has also given me a great deal of confidence in my financial future. If you're looking for a financial adviser who is both effective and easy to work with, Brad is the person to call.Trustindex verifies that the original source of the review is Google. Both my husband and I have been genuinely impressed with the service we've received from Brad at The Guided Investor. We've worked with financial advisors in the past, but none have come close to the level of detail, clarity, and genuinely helpful advice Brad has provided. We're so excited to be working toward early retirement, and Brad has created a financial roadmap that feels both achievable and perfectly tailored to our situation. He explained everything in a way that was super easy to understand—even for people like us who aren't exactly financially savvy! We’ve always had the goals, we just didn’t have the strategies to get there… until now. Brad took the time to understand our circumstances and helped us shape a clear path forward. Plus, the extra links and video guides he provided have been such a helpful bonus! Highly recommend if you're looking for expert advice with a personal, down-to-earth approach.Trustindex verifies that the original source of the review is Google. We’ve had a great experience working with Brad as our financial planner. He’s incredibly knowledgeable, trustworthy, and genuinely has our best interests at heart. We're in the middle stages of our life, and Brad has helped us make smart, long-term decisions to set up a secure future for our kids. His advice is clear and easy to follow, and we always walk away from meetings feeling confident and informed. Highly recommend!Trustindex verifies that the original source of the review is Google. So useful and comprehensive - broke down everything really clearly and cut through jargon which I really needed!Trustindex verifies that the original source of the review is Google. Brad has been helping my wife and me with our superannuation and retirement planning for over 10 years, and we couldn’t ask for a better person to guide us. He’s not only incredibly knowledgeable but also one of the most trustworthy and honest people you’ll ever meet. If you’re thinking about getting your super and retirement plans sorted, I can’t recommend Brad and his team highly enough. You’ll be in great hands!Load more

Did you catch our latest video?

Check out our YouTube channel where we post weekly videos about how you can do MORE with your MONEY.