Bonds can be a valuable asset in the defensive part of portfolios as they are a great tool to get a little bit of extra income without taking on a whole heap of additional risk – provided you pick the right bonds of course!

In this guide we are going to look at the key aspects of bonds so you, as an investor, can better understand what bonds are and how they operate.

What is a bond?

A bond is essentially a loan. When you buy a bond, you are acting as a lender or, more accurately put, a debtholder. The issuer of the bond, which is normally the government or a company, is the borrower – they create the bond.

Like most lender/borrower relationships there are two key aspects – the interest paid by the borrower and the loan repayment date.

In the bond market the interest paid to the lender (in this case the investor) is known as a coupon payment and it is normally paid semi-annually. The size of the coupon payment is always tied to the bond’s initial issuance value (the par value) and is quoted as a percentage of the par. This is known as the coupon rate.

Coupon rate

Put mathematically, the coupon rate is the annual coupon payments divided by the par value of the bond:

Coupon rate = annual coupon / bond par value

Generally, the coupon rate is going to be higher or lower depending on who you are lending money to. For example, if you buy an Australian government bond, you can expect a lower coupon rate than if you bought a corporate bond such as a bank bond. This is because the chances of the Australian government defaulting on the bond are very, very low while the chances of a bank defaulting on a bond are still low, but more likely.

Maturity date & duration

The other key factor is the bond’s maturity date . This is the date at which the bond is repaid at par value (the ‘loan repayment date’). The time until the bond reaches it’s maturity date is known as duration.

The longer the duration, the higher the risk because with time, comes uncertainty. It is easier to predict what is going to happen in the next one year than it is in the next ten. As an investor, you want a better return on your investment to carry that risk.

During risk is why, in general, longer duration bonds tend to have a higher yield than shorter duration bonds. If they don’t, then that’s when we get an inverted yield curve which historically has been a precursor to a stock market crash.

If you anticipate interest rates will fall, you may want to consider opting for long duration bonds. By buying a long duration bond, you lock in a coupon rate for an extended period of time. If you are right, and interest rates fall, then your higher coupon rate is going to mean that your bond is worth more in comparison to new bonds issued at a lower rate.

It is important however to note that floating rate bonds are less sensitive to duration. As floating rate bonds will adjust their coupon rate to match changes in the interest rates, the interest rate risk over a longer period of time is removed to a certain extent. We discuss fixed vs floating rate in more detail below.

As there is a secondary market for bonds, you can buy and sell bonds with other investors before their maturity date which, in-turn, effects the running yield of the bond.

Running yield

The running yield of a bond is the yield relative to the bonds current market value. This differs from the coupon rate which was the yield relative to the bonds par value.

In order to understand how the secondary market for bonds can influence the running yield you need to understand how the running yield is calculated. You simply divide the annual coupon payment by the current market value of the bond:

Running yield = annual coupon / bond market value

Inverse relationship between price and yield

If interest rates rise, the market value of a bond will fall as the return investors can get on their cash has increased. When the market value of the bond falls, the running yield will rise.

Conversely, if interest rates fall, the market value of the bond will rise as the return investors can get on their cash has reduced. This will reduce the running yield.

As a bond gets closer to it’s maturity date, the market value of the bond will get closer and closer to it’s par value despite interest rates as investors anticipate the bond will be paid out at its par value.

Yield to Maturity (YTM)

The YTM represents the total anticipated return on a bond if it is held to maturity. This factors in all anticipated future coupon payments and the market value of the bond.

If your bond is trading below its par value, your YTM is going to be higher. There will be some capital appreciation to enjoy when the bond is paid out at its par value.

Conversely, if your bond is trading above it’s par value, the YTM will be lower, as the market value of the bond will drop as it gets closer to its maturity date.

YTM is a great calculation to consider when buying bonds on the secondary market as it gives a better idea of the internal rate of return of the investment. If you always just rely on the running yield, you will not be considering the change in capital value of the bond.

However, YTM isn’t perfect. The YTM assumes that the bond is held until maturity, which is often not the case, and it assumes that all investment earnings are reinvested at the same rate. None the less, it is still a very helpful calculation to consider when determining if a particular bond purchase is appropriate.

Fixed vs Floating Rate Bonds

A fixed rate bond has a set coupon rate for the entire term of the bond. It will pay the exact same coupon amount in dollar terms until the bond hits its maturity date. On the other hand, a floating rate bond (also known as a variable rate bond) has its coupon change depending on fluctuations in an underlying benchmark interest rate.

It is important to consider whether a bond has a fixed or a floating rate is because a change in interest rates will impact the bond’s coupon and market value differently. If you expect interest rates to rise, floating rate bonds are preferable. If you expect interest rates to fall, fixed rate bonds are preferable.

This also ties into movements of bond prices on the secondary market. The market price of a fixed rate bond will tend to vary more than that of a floating rate bond as the coupon rate doesn’t reflect changes in interest rate. However, there may still be some movement in the market value of a floating rate bond.

If interest rates fall, you can expect that the market value of a floating rate bond will drop which would in-turn increase the running yield to account for the drop in the coupon rate. The value of a fixed rate bond would likely rise which would lower it’s running yield. The opposite would happen if interest rates rose.

Eventually, in a perfect market, two bonds with exact same maturity dates, would have the same running yield. The difference is that one would be holding a capital gain above its par value and the other would be holding a capital loss below its par value.

Where do bonds sit on the risk ladder?

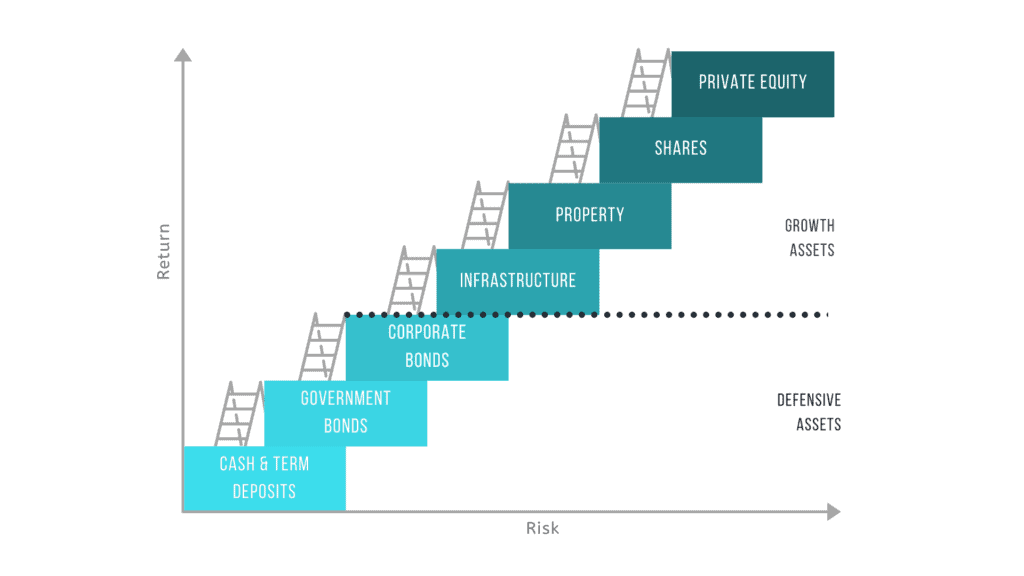

When assessing the risk/return trade-off of any investment, it’s important to consider where it sits on the “risk ladder”. This compares the risk of an asset class with its potential return. When there is more risk, there is more volatility and therefore, we expect a better potential return.

The risk ladder can vary slightly, depending on who you ask and which country you live in. Our version of the risk ladder looks as follows:

As you can see from the image above, both government and corporate bonds are a relatively low risk, low return asset class. You can expect a little variation in their market price due to the secondary market for these bonds but, if you buy quality bonds with little risk of default, then you know that by holding the bond to maturity you can get back the par value of your bond.

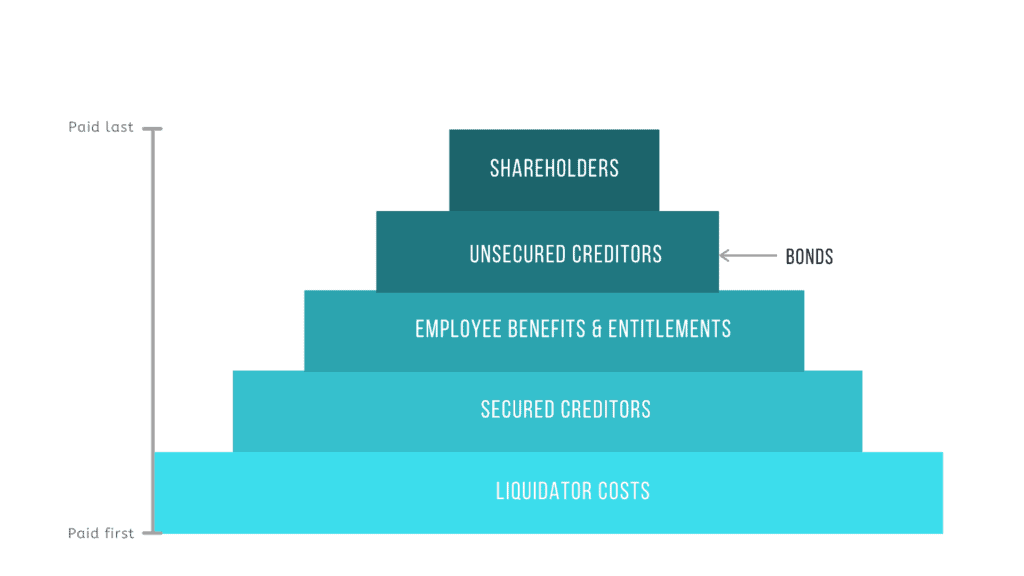

Attributing to the low risk nature of bonds is where they sit in the priority of liquidation relative to shares. This is illustrated below.

As a corporate bond holder, if the issuer of the bond goes into liquidation, you will be paid out before shareholders. Put simply, if a company fails you will be more likely to recoup some, or all, of your investment if you own bonds in the company as opposed to shares in the company.

Risks of bonds

As with all asset classes, bonds come with risks which need to be considered. The key risks are as follows:

- As we already discussed, there is a secondary market for bonds. This secondary market causes bonds to trade at a premium or discount to the bonds par value. As a result, there will be fluctuations in capital value of your investment. In a normal market, this fluctuation is significantly less than shares.

- Bonds are sensitive to interest rate changes. A change in interest rates will impact the market value of your bond. This can be mitigated to an extent by floating rate bonds.

- The purchasing power of a bond’s coupon payments are going to be impacted by inflation, particularly in bonds with a long maturity date. If inflation is high, your purchasing power reduces and this will likely lead to higher interest rates which is all negative for bond prices.

- If you buy individual bonds you may be subject to liquidity risk. That is, you cannot find a buyer for your bond holding in the secondary market. Liquidity risk can be overcome to an extent by using bond funds.

- When you buy bonds you run the risk that the bond issuer is unable to make interest or principal obligations and therefore default. This is known as credit risk. You should always look to buy bonds in governments and companies which have strong balance sheets and good cash flow.

Despite these risks, bonds are still considered a defensive asset class. Defensive assets are the investments which give you a good “sleep well at night” factor because there is little risk of your capital disappearing. The return from bonds isn’t amazing, but you do get a margin of income above what you would get from a savings account.

How to buy bonds

With all asset classes, it’s prudent to take a diversified approach to investing. Bonds are no different. Instead of buying individual bonds, consider using either a passive or active bond fund. This will allow you to get a broad exposure to a number of bonds with a single holding.

There are many ways you can buy bond funds including exchange-traded funds (ETFs), managed funds, listed investment companies (LICs) and mFunds. ETFs and LICs are common amongst DIY investors due to their accessibility. They are listed on the Australian stock exchange (ASX) so all you need is an online broker account to access them.

Final thoughts

Quality bonds are a great asset class to serve as a store of wealth while giving you a slightly better return than cash. There are some risks to consider before investing in bonds, but the risks are manageable and bonds can comfortably be considered a defensive asset.

For younger people, with a long investment time horizon, bonds are not going to provide you a great long-term return. They can be used in an accumulators portfolio as a short-term store of wealth while you wait for an opportunity in equity markets, but they shouldn’t take the place of equities in the long-term.