Why take risk?

There are a few tenets which I try and live my life by and one of them is, when faced with a decision I ask myself – if I look back on my death bed, will I be happy I did it?

Now I don’t think I am going to look back on my death bed and say, “geez I am glad I lived a risk-free and sheltered life”. I am guessing the things that stand out the most, those precious memories that I cherish forever, are going to be the ones where I took a risk, and it paid off.

I’m not referring to reckless risks like an Evel Knievel type stunts (although he was very successful across many metrics by doing crazy stuff). That kind of risk could be the reason I am in my death bed in which instance I am sure I would regret it! I am referring to measured risks where the potential gain outweighs the potential loss.

For instance, maybe you overcome your fear of rejection and strike up a conversation with a random at a bar and that person turns out to be the one you marry and spend the rest of your life with. Or maybe you apply for a dream job which you are clearly underqualified for, but you fake it until you make it and turn it into a rewarding and lucrative career.

My point is, life is about taking risks and it is no different when it comes to your finances.

Taking risks with your money

Without taking measured risks with your money, you are guaranteeing yourself a mediocre outcome. You will have to work harder than the person that invests because the investor has their capital working for them.

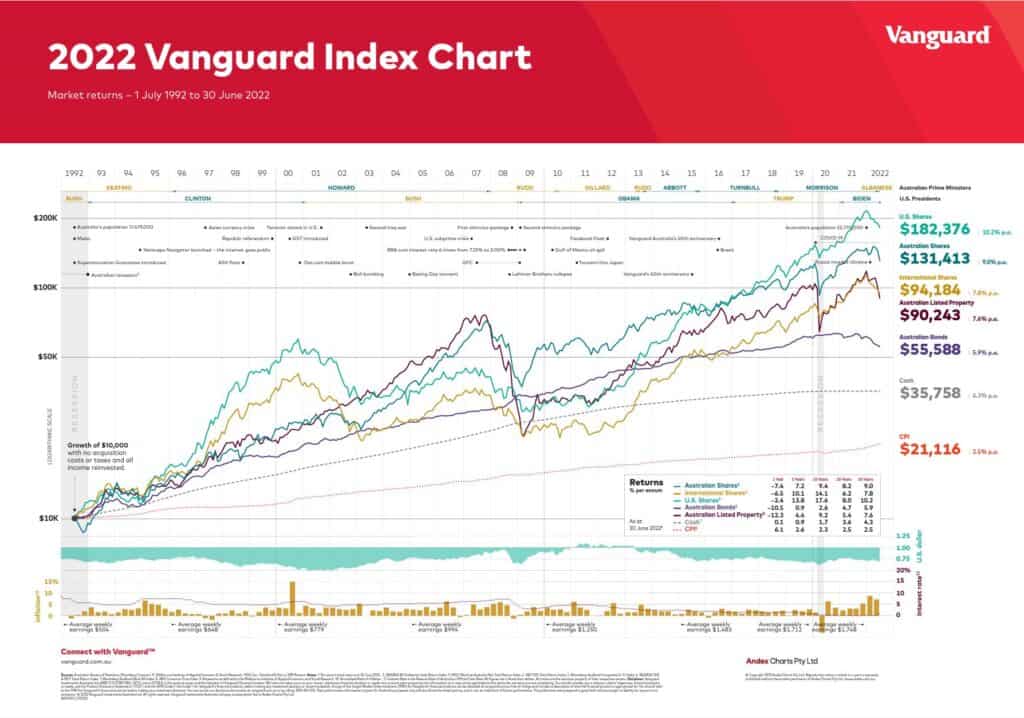

To explain this concept, let’s look at the Index Chart that Vanguard puts out every year.

This chart shows the return on your money if you had invested $10,000 back in 1992 with no additional contributions but all income reinvested.

It breaks down the return into different asset classes including US Shares, Australian Shares, International Shares, Australian Listed Property, Australian Bonds, Cash and it even shows CPI which is obviously a measure of inflation.

This chart paints a very powerful picture because it shows how the different asset classes have behaved over time.

Defensive vs growth assets

If we look at the defensive style assets which include Cash and Bonds, they have provided a steady return with very little short-term risk to your capital, with the exception of Bonds over the last 12 months due to rising interest rates.

On the other end of the spectrum, look at Shares and Property. Over time they have been on a rollercoaster of a ride with particularly big shocks around the dot com bubble in 2000, the global financial crisis (GFC) in 2008, the COVID crash in 2020 and even now in 2022 with the heated inflation and rising rates.

But let’s for a minute focus on the long-term outcome rather than the short-term movements.

On the very conservative side we have cash. If you put $10,000 into a cash account in 1992, today you would have $35,758. That is an annualised return of 4.3% p.a.

However, if you put that same $10,000 into US Shares, today it would be worth $182,376. That is an annualised return of 10.2%.

Given this, you tell me what is more risky for a long term investor – cash or shares? Most uneducated people who don’t understand investing will say shares. I believe it is riskier to hold too much money in cash.

Why is cash risky?

The risk of cash is that you aren’t generating a meaningful return on your capital. At the moment, you are generating less than inflation so it is a negative real return. This means you will either have to save a higher portion of your income or work longer to hit your financial independence goals.

I believe a better option is to earn an income to build up capital and then put that capital to work so it builds wealth for you. That is investing.

What’s the catch?

Now there are a few important points to make here.

Firstly, investing is very risky if you have a short timeframe, say less than 7 years. Have a look at the GFC we talked about earlier, between the period of October 2007 to March 2009 you would have lost (on paper) about half of your money. Ouch!

That is why, before investing, you need to understand how long your investment timeframe is. I have both retired clients and accumulators which I look after, and their portfolios are very different because their investment timeframes are different.

Secondly, these figures are based on index investing (which I would suggest most novice investors do). If you want to try and be a stock picker, investing in the next big start-up, then that contains a whole lot of risk regardless of your timeframe. It is more like gambling than investing.

I believe that investing involves a portfolio of diversified, high-quality assets. For larger portfolios, I opt for the Core + Satellite approach to investing, for smaller portfolios I stick with passive, index investing.

Thirdly, just because I don’t think cash is a good long-term investment, doesn’t mean that you shouldn’t hold any cash. I encourage everyone to maintain an emergency fund. When talking about investing we are talking about the excess money you may have above your emergency fund. Under my system, investing really comes into play in phase two of wealth creation.

Final thoughts

To wrap this one up, I wanted to share a quote by John A. Shedd; “a ship in a harbour is safe, but that is not what ships are built for”. Cash is the harbour, if you want your money to work for you, which it is designed to do, you have to invest it.

If you would like our help with creating a investment strategy which suits your personal situation, please checkout our Tailored Advice solution.