A non-concessional contribution is an after-tax superannuation contribution. In other words, you use money which you have already paid tax on (like savings in your bank account) and contribute it into your super fund.

Unlike a concessional contribution, you don’t get to claim a tax deduction when making a non-concessional contribution, nor does your super fund pay tax upon entry into the fund. It is basically like taking a dollar of personal savings and transferring the ownership of that dollar to your super fund.

Why make a non-concessional contribution?

There are many reasons why you might want to make a non-concessional contribution into your super fund. This can include the following:

- Access to the government co-contribution. Subject to eligibility requirements, the government may match your contribution 50 cents for every $1 contributed up to a maximum co-contribution of $500;

- Access to the eligible spouse contribution. Subject to eligibility requirements, you may receive a tax offset of $540 if you contribute $3,000 or more into your spouse’s superannuation account as an eligible spouse contribution;

- Non-concessional contributions can be a great way to transition money into superannuation where funds are invested tax-effectively. Many retirees and pre-retirees use non-concessional contributions to transition their wealth into a tax-free pension account;

- Increase your Age Pension entitlement. If one member of a couple is below Age Pension age and the other member is eligible, you can quarantine assets in the younger spouses accumulation account and not have them counted towards the income and assets test; and

- To implement a re-contribution strategy. This involves taking money out of your super and recontributing it back as a non-concessional contribution in order to change the components from taxable to tax-free. This can have estate planning tax benefits when paying a death benefit to a non-dependent like your adult children. To learn more about tax payable on death benefits see ‘Payment of death benefits from superannuation‘.

How much can you contribute as a non-concessional contribution?

There is a cap limit on how much you can contribute each financial year into superannuation as a non-concessional contribution. The cap limit is always four times that of the concessional contribution cap limit which makes the current cap limit $120,000 in the 2024/25 financial year.

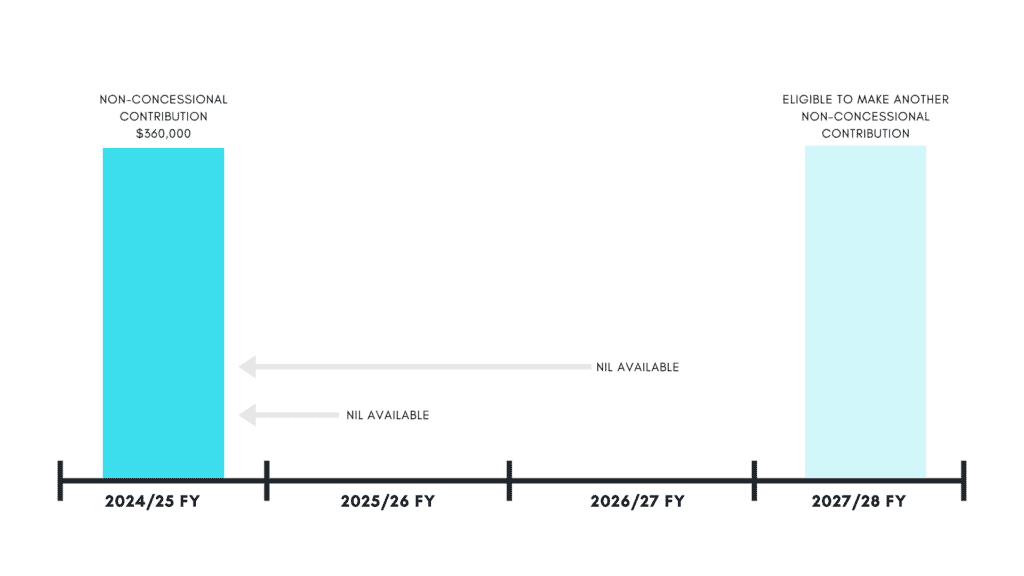

There is a bring-forward rule which allows you to bring forward two additional years of contributions into a single financial year.

For instance, in the current financial year, you could contribute $360,000 by bringing forward the 2025/26 and 2026/27 years cap limits. This would mean you can’t make any additional non-concessional contributions until the 2027/28 financial year.

Eligibility requirements for a non-concessional contribution

In order to make a non-concessional contribution, there are eligibility requirements which you need to meet.

You need to be under the age of 75 and your Total Superannuation Balance (TSB) needs to be less than the general Transfer Balance Cap (TBC) on 30 June of the previous financial year. The TBC is currently $1.9 million in the 2024/25 financial year.

Where you are close to the TBC, you need to be cautious when using the bring-forward rule. The following table outlines the maximum contribution you can make using the bring-forward arrangement:

| Total Superannuation Balance at 30 June of the prior financial year | Maximum contribution you can make | Accounts for contribution caps in |

| $0 to less than $1.66 million | $360,000 | Current year + following 2 years |

| $1.66 to less than $1.78 million | $240,000 | Current year + following year |

| $1.78 million to less than $1.9 million | $120,000 | Current year |

| $1.9 million and over | Nil | Current year |

Considerations before making a non-concessional contribution

Before making a non-concessional contribution, there are a number of things you need to consider first, including the following:

- Contributions are preserved in your superannuation until you meet a condition of release. The most common condition of release is reaching preservation age and retiring from the workforce or attaining age 65. You need to familiarise yourself with the conditions of release before making a contribution.

- Superannuation is subject to legislative changes. Rules around superannuation may change which could result in adverse outcomes for you. The further you are away from preservation age, the higher the potential risk of legislative changes.

- If you exceed your non-concessional contribution cap, including any bring-forward amounts, the excess contributions are subject to a significant tax penalty of 47%. This penalty tax applies to the excess contribution amount unless you choose to withdraw the excess contributions from your superannuation fund. In addition to the penalty tax on the excess contributions, any associated earnings on those excess amounts are also subject to penalty tax.

- The bring-forward rule is automatically triggered when a non-concessional contribution exceeds the annual cap of $120,000. Once triggered, you have until the end of the third year to utilise the remaining contribution cap space. It’s important to note that when the bring-forward rule is activated, the contribution cap amount is fixed and will not increase with indexation in the following two years.

- Before putting any additional money into superannuation, you want to ensure you understand (and are comfortable with) the investment strategy and fee structure within your super fund.

How to make a non-concessional contribution

Making a non-concessional contribution is easy. Most super funds allow you to make contributions using payment systems like BPAY, electronic funds transfer or cheque.

You can make a non-concessional contribution as a single lump sum or as lots of smaller contributions throughout the year – it’s up to you.

You don’t need to notify the ATO you are making a non-concessional contribution. Most super funds assume voluntary member contributions are non-concessional unless you inform them otherwise.

The Guided Investor approach

Non-concessional contributions come into play predominantly in Phases 3 and 4 of the Wealth Creation process, when you are approaching (or have met) preservation age. They can be a great tool to help maximise Age Pension, boost assets held in a tax-free pension account, or minimise tax on a death benefit payment to a non financial dependent.

We typically don’t recommend a non-concessional contribution to an accumulator in Phase 2 of Wealth Creation unless eligible for the government co-contribution, eligible spouse contribution or some other benefit that may be unique to their situation.