If you have a sedentary job then there is a very good chance that you spent part of 2020 working from home. I know I certainly did. The upside of this is that you may be eligible for a few additional tax deductions this year – winning!

You see, as a general rule of thumb, any expense incurred in earning taxable income is a deductible expense. As a result of working from home, you would likely have incurred some additional expenses such as increased electricity costs or maybe you had to buy a computer chair because the couch was killing your back. These expenses are all potentially tax deductible.

So today I want to put together a little guide as to what you should be looking at claiming in your 2020 tax return. However, I do want to preface this by saying that I am not a tax adviser. The information contained here has come straight from the ATO and is general in nature. If you want to know how to apply this information to your personal situation then you should speak with a licensed accountant.

Expenses you can claim

Let’s kick things off by taking a more detailed look at some of the expenses you are eligible to claim as a result of working from home. The ATO has listed the following items:

- electricity expenses associated with heating, cooling and lighting the area from which you are working and running items you are using for work

- cleaning costs for a dedicated work area

- phone and internet expenses

- computer consumables (for example, printer paper and ink) and stationery

- home office equipment, including computers, printers, phones, furniture and furnishings – you can claim either the

- full cost of items up to $300

- decline in value for items over $300

If you think some of these expenses are applicable to you then great – you may be able to claim it. In order to be eligible you must be able to show that you actually spent the money and have records to prove it.

For example, if you are using your mobile from home but your mobile is paid for by your employer or your employer reimburses you for this cost, then you obviously can’t claim it. But if you have been using your mobile from home, the bill is in your name and your employer doesn’t rebate the cost to you, then likelihood is you will be able to claim a portion of your bill. Some employer’s might also give you an allowance for this expense in which case you can still claim the expense but must include the allowance as taxable income.

One interesting aspect in the list of claimable items, which I believe needs further explanation, is the equipment expenses. I think this will potentially relate to a lot of people because I know personally, we tried to buy a web cam and couldn’t get one because they were all sold out!

If the equipment you purchased cost less than $300 then you can generally claim the full expense. If the equipment you bought was over $300 then you have to claim the ‘decline in value’ which means you have to depreciate the item.

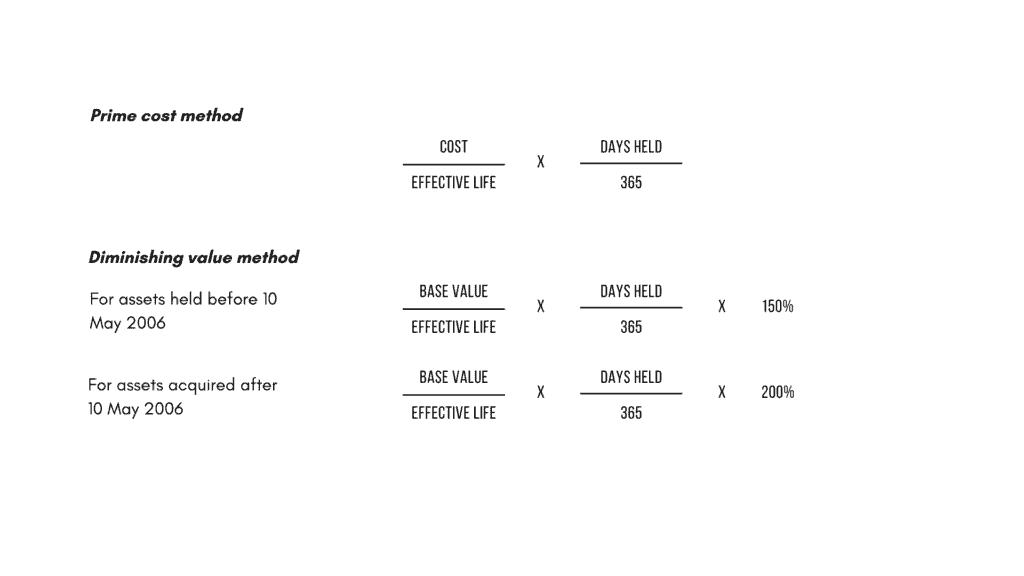

When you depreciate an asset you essentially claim a portion of the value of that asset each year given its effective life. There are two methods you can use, the prime cost method and the diminishing value method. These calculations are as follows:

A component of both these calculations is the effective life. This is the number of years the asset is expected to last for. In order to work out the effective life, you can check out the commissioner’s determination. As an example, a computer is typically depreciated over 4 years.

When you start depreciating assets your tax return does become more complicated. Not only do you have to work out the depreciation applicable for the relevant tax year but also you need to consider how much of the asset is used for work purposes. If an asset is used for both work and private use, only the work portion is tax deductible.

When it comes to claiming electricity expenses and cleaning costs, again you can’t claim your full bill. Generally, it is easier if you have a dedicated home office which you use for work. You will need to calculate the size of the home office as a percentage of the floor area of the entire house and proportion your expenses accordingly. If you don’t have a home office and, are using a space which is occupied by other family members, generally the electricity and cleaning costs won’t be tax deductible.

So as you can see, claiming work related home expenses can be quite tricky if you use the actual cost method. It might be best to seek the professional advice from an accountant if you intend to go down this path. Alternatively, you could use the ATO’s short cut method to simplify the process.

The short cut method

As we have already seen, it can start to get a little complicated to do your own tax return if you have multiple expenses, particularly asset purchases which need to be depreciated. However, the ATO has given us a more simplified approach to lodging your tax and that is the short cut method.

This method is only available for the period 1 March 2020 to 30 June 2020 and is an alternative to the actual cost method which is intended to cover all of your work from home expenses including:

- phone expenses

- internet expenses

- the decline in value of equipment and furniture

- electricity and gas for heating, cooling and lighting.

In order to use this method you need to keep a log of the number of hours you worked from home. This log might be a timesheet, roster, diary or any other document which tracks the time spent working from home.

Once you know how many hours you have worked from home you can claim a deduction of 80 cents for each hour you worked form home during the eligible period. So for example, if you were working from home from 1 March to 30 June 2020, 5 days per week, 8 hours per day then this would equate to a deduction of roughly $550.

While this method is simple, your likely not going to get as much bang for your buck, particularly if you have purchased equipment to work from home. Also, bear in mind that if you use this method, you can’t also claim expenses under the traditional ‘actual costs method’ so if you started working from home before 1 March 2020 then maybe this method won’t be appropriate for you.

There is also a fixed rate method which I am not going to go into detail about. It is essentially like the short cut method but instead of claiming 80 cents per hour you can only claim 52 cents per hour. The difference is the work from home period isn’t restricted to the days between 1 March and 30 June 2020 and you can also claim additional expenses on top of the fixed rate method including phone expenses, internet expenses, computer equipment and depreciation.

If you aren’t sure which method to use, again I would recommend you seek professional tax advice.

Expenses you can’t claim

Tax deductions are great but let’s not get carried away, not everything is tax deductible! If you are an employee working at home, you can’t claim costs:

- for coffee, tea, milk and other general household items your employer may otherwise have provided you with at work

- related to children and their education including setting them up for online learning, teaching them at home or buying equipment such as iPads and desks

- that you’re reimbursed for, paid directly by your employer or the decline in value of items provided by your employer – for example, a laptop or a phone.

Generally, as an employee, you also can’t claim housing costs such as rent, mortgage interest, water and rates. This is different if you are self-employed and you operate from your house but as an employee these expenses are generally not tax deductible.

Final thoughts

COVID-19 has caused a lot of headaches for many people this year and if we can get a little tax relief as a small silver lining then that is great. However, calculating your deductions can be a complex area and you don’t want to mess it up because if you get audited, penalties could apply.

If you are going down the DIY route for your tax return this year, you should consider keeping it simple and using the ATO’s short cut method. If you have large capital purchases over $300 then it may be worthwhile paying for some professional tax advice.