This week the government handed down their Federal Budget and it was the cash spend that we were all expecting, with money going to job training, health funding, childcare, aged care, infrastructure and a number of other areas.

The big cash splurge is largely due to the recovery we are still going through from COVID-19 but I have a sneaky suspicion it might also have something to do with a Federal Election coming up in the not-too-distant future.

But today I want to focus on the aspects of the budget that I think are important for you. Now please remember that all of these measures are not legislated yet, they need to pass through parliament before they become law.

SUPERANNUATION

Let’s kick things off with superannuation because, as you all know, I’m a big fan of super and there were some important announcements here.

Repealing the work test for non-concessional contributions and salary sacrifice contributions for people aged 67 to 74

There is a suggested repeal of the work test expected from 1 July 2022. Currently, Australians aged 67 – 74 must satisfy a work test in order to contribute to super. That is, they must work a minimum of 40 hours over a consecutive 30-day period to make super contributions.

This work test will no longer apply when making non-concessional super contributions or salary sacrificed contributions. People in this age group will also be able to access the non-concessional bring forward arrangement which allows you to bring-forward 2 years of future contributions into a single year, subject to meeting the relevant eligibility criteria.

Now bear in mind, this doesn’t cover personal deductible contributions. People aged 67 – 74 will still need to meet the work test to make personal deductible contributions to super.

Reducing the eligibility age for downsizer contributions to 60

Next up, we have the reduction in the eligibility age for the downsizer contribution from age 65 to age 60 expected from 1 July 2022.

If you don’t know what the downsizer contribution is, it’s a way for eligible people to sell their principal residence of 10+ years and contribute up to $300,000 of the proceeds into super (each person). Now the beauty of this is that it doesn’t form part of your traditional super cap limits so this could potentially allow a couple, over the age of 60 to contribute a combined $1.26 million into super in a single year from 1 July 2022.

Removing the $450 per month minimum superannuation guarantee threshold

Expected from 1 July 2022, the Government has announced it intends to remove the $450 per month minimum superannuation guarantee (SG) income threshold. Under the current rules, an employer is not required to pay superannuation guarantee contributions for an employee who earns less than $450 per month.

This is obviously a positive for people who work part-time or casual because the more you contribute to super and the earlier you do so, the better off you will be in retirement.

That summarises the primary changes to super. There were some additional announcements around complying pension and annuity conversions and relaxing residency requirements for SMSFs but that is very specific to a small group of people so I won’t touch on that now.

What is important to note however is that there was no mention of ceasing the increase to superannuation guaranteed contributions (SGC). This means that, as planned, from 1 July 2021 the SGC will increase from 9.5% to 10%.

In addition, the Government did not announce an extension of the halving of the account based pension minimums. As a result, the standard minimum drawdown requirements will apply from 1 July 2021.

HOME OWNERSHIP

First Home Super Saver Scheme – increasing the maximum releasable amount to $50,000

The Government has announced it will increase the maximum releasable amount for the First Home Super Saver Scheme (FHSSS) from $30,000 to $50,000, expected from 1 July 2022.

The FHSSS is a way for first home buyers to save up a deposit for their first house tax-effectively using their super. For the right people, this can be a very powerful strategy. I have done a video on this strategy in the past if you want further information.

I am a big fan of this change because I like the scheme and encouraging people to save a bigger deposit is always going to put them in a safer position financially.

Family home guarantee for single parents

The Government has introduced the Family Home Guarantee as a way of providing a pathway to home ownership to support single parents with dependants. This is regardless of whether they are a first home buyer or a previous owner-occupier.

From 1 July 2021, 10,000 guarantees will be made available over four years to eligible single parents with a deposit of as little as 2%, subject to an individual’s ability to service a loan.

This will help a lot of single parents as saving a house deposit can be very difficult. Under this scheme you will be able to save a smaller deposit and not pay lenders mortgage insurance (LMI) nor need a family member to go guarantor. But always remember, the more you can save for yourself, the better off you will be.

New home guarantee

The Government is providing a further 10,000 places under the New Home Guarantee in 2021/22. This is specifically for first home buyers seeking to build a new home or purchase a newly built home with a deposit of as little as 5%.

I won’t go into detail on this as I have done a video previously about it which you can find on my YouTube channel.

CHILD CARE

Increase in child care subsidy

Effective from the 11 July 2022, the Government announced it will:

- increase the Child Care Subsidy (CCS) rate by 30 percentage points for the second child and subsequent children aged five years and under in care, up to a maximum CCS rate of 95% for these children, commencing on 11 July 2022, and

- remove the CCS annual cap of $10,560 per child per year commencing on 1 July 2022.

This will allow parents to work a bit extra and still get the benefit of child care subsidy. I think this is a great move because a lot of parents are torn between wanting to work more but it not being financially viable due to the increased cost of childcare.

PERSONAL TAX

Retaining the low and middle income tax offset for the 2021-22 income year

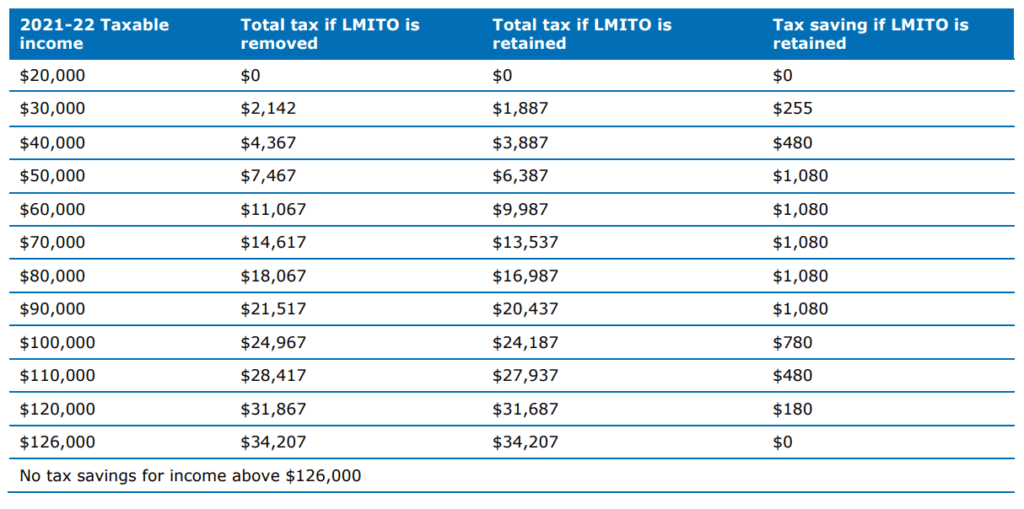

The Low and Middle Income Tax Offset (LMITO) was due to be removed at the end of the current financial year. However, the Government has announced it will retain LMITO for the 2021-22 income year.

The LMITO provides a reduction in tax of up to $1,080. The table below is a good one which summarises the potential benefit of the LMITO at different income levels.

There is not much else to report on the personal tax side of things other than a proposal to remove the cessation of employment as a deferred taxing point for employee share schemes and a slight increase to the medicare levy low-income thresholds.

BUSINESS TAX INCENTIVES

Extending temporary full expensing

The temporary investment tax incentive announced in last year’s Budget has been extended for a further 12 months until 30 June 2023 giving businesses additional time to utilise the incentive and including for projects requiring longer planning times. Businesses with a turnover up to $5 billion will be able to deduct the full cost of any eligible asset they purchase for their business, including the cost of improvements to existing assets, until 30 June 2023.

Temporary loss carry-back provision

Companies will now be permitted to carry back tax losses for an extra 12 months from the 2019/20, 2020/21, 2021/22, and now 2022/23 income years to offset previously taxed profits in 2018/19 or later income years. This too applies to businesses with an aggregated turnover of less than $5 billion.

SUMMARY

Overall, this is a crowd-pleasing budget. It puts some money back into the pockets of individuals and there are a number of spending initiatives that will benefit the economy and those in need like health care and aged care.